As of this writing, no deal has yet been reached on the $700 billion bailout plan, but the word is that something will be coming “soon.” To be sure, there is plenty of sentiment against the notion that “…garbage collectors in Gloomsville should pay [higher] taxes so that $1,000-an-hour bankers can retain their seats at the Wall Street casino.”

Jeff Randall, editor at large for the London Daily Telegraph continues: “They had their fun and they lost their chips. Correction, they lost other people’s chips.”

It seems to me that any bailout should try to save those mortgage holders who really do want to stay in their homes, and can afford to take some medicine, rather than just propping up banks that happen to have curried sufficient political favor. Beyond that, the market should take it course, and the Feds should butt out.

The roots of this mess go all the way back to 1977 (remember Jimmy Carter?) and the Community Reinvestment Act, which essentially forced banks to lend to more high-risk borrowers. But hey, that would be no problem, given the backing of Fannie Mae and Freddie Mac, big government-sponsored entities, which themselves are overseen by the Office of Federal Housing Enterprise Oversight (OFHEO).

Maybe not. Only months before the Feds had to completely rescue Fannie Mae and Freddie Mac, OFHEO gave them a clean bill of health. Now we’re told that as early as 1992, things did not exactly look rosy for Fannie and Freddie. It was Bill Clinton, for heaven’s sake, who said that the Democrats have been “resisting any efforts by Republicans in the Congress or by me…to put some standards and tighten up a little on Fannie Mae and Freddie Mac.”

Still, don’t get too fooled by the politics, since it was Clinton who appointed master of disaster Franklin Raines as CEO of Fannie Mae, after a less-than-distinguished tenure in other positions in his administration. Many think that Raines should be doing jail time for the many irregularities uncovered in his government career, the most recent of which was obtaining below-market loans from Countrywide, while CEO of Fannie Mae.

Even as a retiree, Raines can’t keep away from controversy. He has been linked to the Obama campaign, mostly based on his own statements, although this has been denied by Obama.

Home ownership has always been favored by the American government, and that’s why we still have—almost uniquely among Western democracies—an income tax deduction for mortgage interest. For the most part, mortgage lending was a nice, conservative, steady, low-risk business, until there was even more pressure to make questionable loans, combined with financial whiz-kids who would package all sorts of products to accommodate the seemingly nonstop market.

In the wake of the so-called subprime loans came a variety of dubious mortgage-backed securities, which were initially given top ratings by the credit raters, along with AIG to back up all the investments. The subprime loans even led to the so-called NINJA loans: no income, no job, no assets. Companies like Lehman wagered far too heavily in this area, to get short term high profit numbers and big bonuses.

As it happened, of course, the rating agencies were way off, and finally reacted by severely downgrading the securities. This made AIG’s position untenable, and there was probably justification for the Feds to take an interest at that point. Heck, the Feds could make money by auctioning off these assets.

Do we need more regulation? Not at all. There is more than enough already. What we need is a whole lot less politics. After all, up until quite recently political hacks like Barney Frank (D-MA) were attempting to reassure the public that everything was just fine. And although there’s plenty of blame to go around on both sides, the Dems have made a career of using victimization such as “Minorities are discriminated against in mortgage lending” to buy votes and influence.

Since the mere perception of racism is now the greatest possible human sin, that would even trump prudent lending policies dating back to the Middle Ages, the flaws were hidden for far too long.

I hope it was worth it.

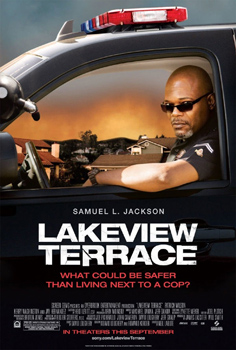

Compelling themes and a strong performance from Samuel L. Jackson propel this one beyond the deficiencies of its third act. Most mainstream critics that didn’t like the pic felt that way because of its far-from-PC take on race—even if there’s much truth in what it portrays.

Compelling themes and a strong performance from Samuel L. Jackson propel this one beyond the deficiencies of its third act. Most mainstream critics that didn’t like the pic felt that way because of its far-from-PC take on race—even if there’s much truth in what it portrays. Despite a bad script, less than stellar editing, and too many iconic actors wasted in tiny roles, this pic still is mostly fun to watch, based on the presence of De Niro and Pacino. Some atmosphere is lost with Bridgeport, CT being used—with little success—to portray Manhattan.

Despite a bad script, less than stellar editing, and too many iconic actors wasted in tiny roles, this pic still is mostly fun to watch, based on the presence of De Niro and Pacino. Some atmosphere is lost with Bridgeport, CT being used—with little success—to portray Manhattan.